Income Tax

HMRC has confirmed that MTD reporting will apply in respect of Income Tax for the self-employed and landlords with gross incomes of £50,000 or more from April 2026, and those with gross incomes of between £30,000 and £50,000 from April 2027.

Finally, those with incomes of £20,000 or more will be required to follow the same rules from April 2028.

This will require these taxpayers to report and submit information digitally on a quarterly basis using HMRC-compliant software, as well as an annual confirmation statement.

To help you better understand the steps you need to take now, read our latest guidance:

VAT

HMRC’s vision to digitise the UK tax system is now well underway. The process started in April 2019 with VAT registered businesses with turnover exceeding the VAT threshold (currently £85,000) being required, from this date, to use compliant commercial software to maintain their VAT records and send their VAT information to HMRC every quarter.

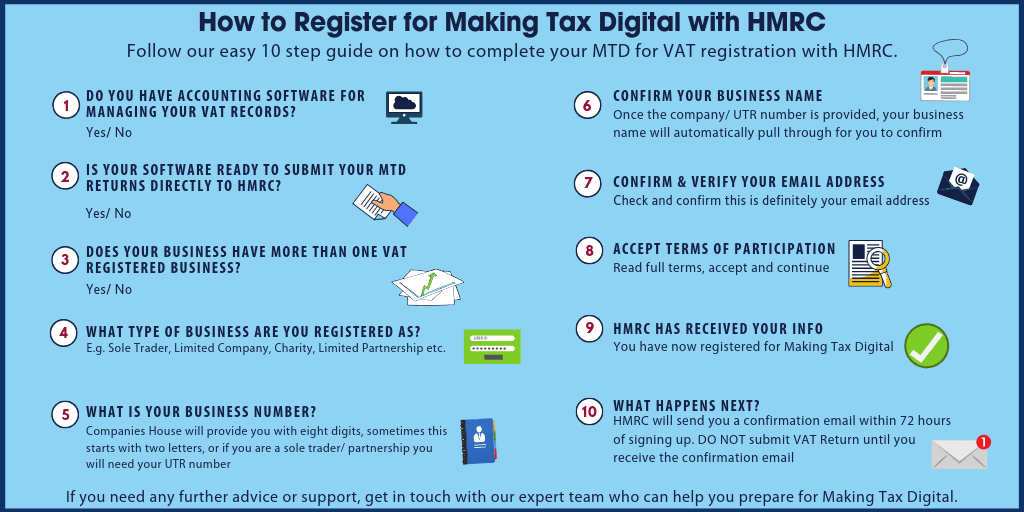

View our infographic on how to register for Making Tax Digital with HMRC

Stay informed

At Moore Thompson we are here to help our client’s ensure they are as prepared as possible for the changes ahead both by keeping you up to date with the latest developments as released by HMRC, and the software providers, but also in providing you with new and improved online accountancy software and bookkeeping options.

To keep up to date with the latest MTD news register now for our weekly MTD blogs.

To find out how we can help your business comply with Making Tax Digital, please contact our tax team now.

To find out more about our online accountancy services, please contact us.